eXp World Holdings Reports Record First Quarter 2021 Financial Results and Agent Growth

Q1 2021 Revenue Increased 115% to $584 Million Year-over-Year, Driven by Agent Growth of 77%

BELLINGHAM, Wash., May 06, 2021 (GLOBE NEWSWIRE) — eXp World Holdings, Inc. (Nasdaq: EXPI), (or the “Company”), the holding company for eXp Realty, Virbela and SUCCESS Enterprises, today announced financial results for the first quarter ended March 31, 2021.

First Quarter 2021 Financial Highlights:

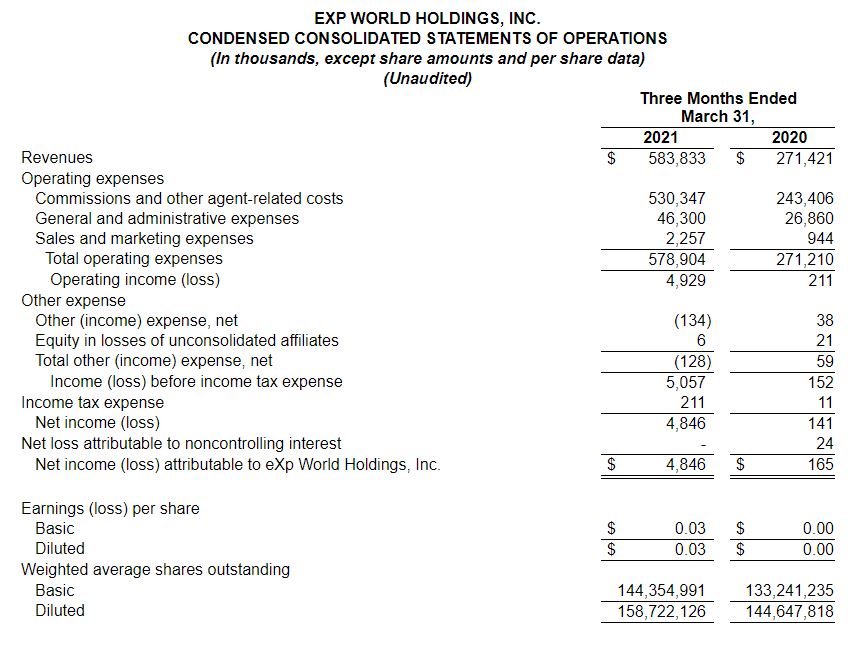

- Revenue increased 115% to a record $583.8 million in the first quarter of 2021, compared to $271.4 million in the same year-ago quarter.

- Gross profit increased 91% to $53.5 million in the first quarter of 2021, compared to $28.0 million in the same year-ago quarter.

- Net income increased 3,348% to $4.8 million in the first quarter of 2021, compared to $0.1 million in the same year-ago quarter.

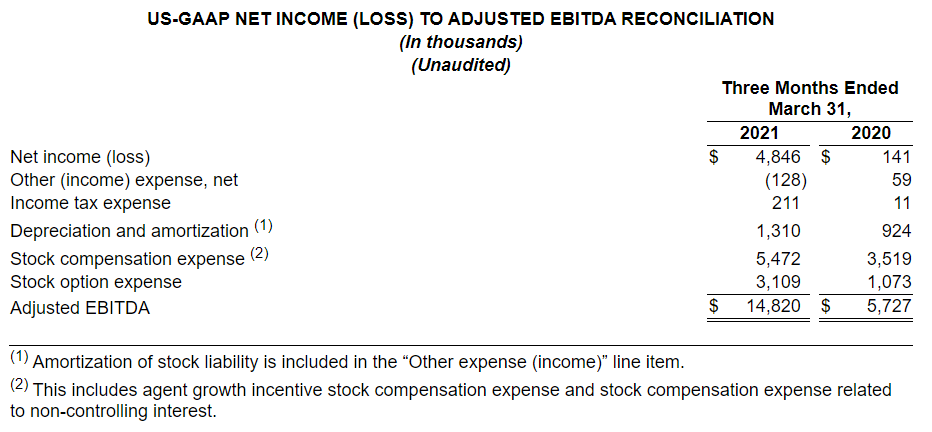

- Adjusted EBITDA (a non-GAAP financial measure) increased 159% to $14.8 million in the first quarter of 2021, compared to $5.7 million in the same year-ago quarter.

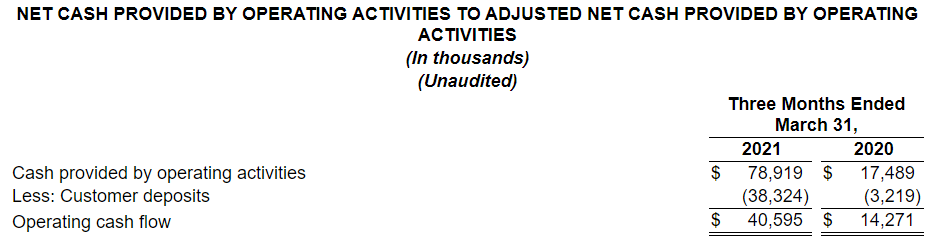

- Operating cash flow (a non-GAAP financial measure) increased 184% to $40.6 million in the first quarter of 2021, compared to $14.3 million in the same year-ago quarter.

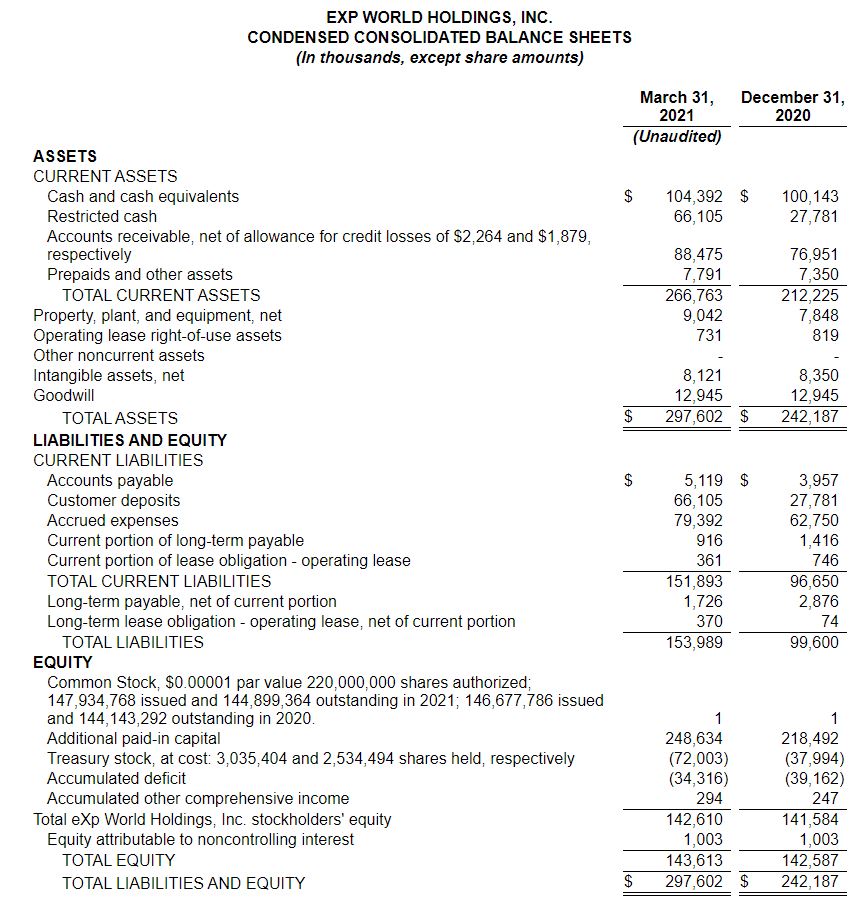

- As of March 31, 2021, cash and cash equivalents totaled $104.4 million, compared to $44.3 million as of March 31, 2020. The Company repurchased approximately $34.0 million of common stock during the first quarter of 2021.

Management Commentary

“As the fastest organically growing real estate brokerage in the world, we are making considerable progress with gaining market share in the U.S. and globally, having grown our agent base 77% year-over-year to exceed the 50,000-agent milestone in the quarter,” said Glenn Sanford, Founder, Chairman and CEO of eXp World Holdings.

“Our record first quarter revenue and profitability is a direct result of agents continuing to find success leveraging eXp’s unique brokerage model and agent value proposition. Not only are we experiencing an acceleration in the number of agents joining eXp, but the agents we are attracting have proved to be increasingly productive and our Net Promoter Score continues to climb.

“While the sustained strength in the broader real estate market has provided a complementary environment for our core operations, our record results are attributable to eXp’s commitment to surrounding our agents with an unmatched suite of tools and resources that drive positive engagement. This growth of our cloud-based business is being achieved entirely within our virtual working environment, which serves as a key differentiator for aggressively scaling our platform internationally, as well as in the U.S. where a significant opportunity to continue capturing market share remains. As we move forward, we will maintain our focus on finding innovative ways for real estate professionals to succeed in the most agent-centric model on the planet,” concluded Sanford.

First Quarter 2021 Operational Highlights:

- Agents and brokers on the eXp Realty platform increased 77% to 50,333 at the end of the first quarter of 2021, compared to 28,449 at the end of the first quarter of 2020.

- Residential and commercial transaction sides closed increased 95% to 73,878 in the first quarter of 2021, compared to 37,882 in the same year-ago quarter.

- Residential and commercial transaction volume closed increased 123% to $24.5 billion in the first quarter of 2021, compared to $11.0 billion in the same year-ago quarter.

- eXp Realty expanded into four new international locations and territories in the first quarter of 2021, including Puerto Rico, Brazil, Italy, and Hong Kong. Subsequent to the end of the first quarter, the Company successfully launched in Colombia, and announced plans to establish operations in Spain and Israel by the end of the second quarter of 2021.

- eXp Realty ended the first quarter of 2021 with a 73 global Net Promoter Score, a measure of agent satisfaction, through the Company’s intense focus on the agent experience. This compares to a 70 global Net Promoter Score at the end of the first quarter of 2020.

“Our substantial year-over-year increases in revenue and cash flow generation were driven by industry-leading agent growth and sustained transaction volume,” said Jeff Whiteside, CFO and Chief Collaboration Officer of eXp World Holdings. “Beyond the inherent advantages of our agent compensation model, our tech-enabled offerings are increasingly contributing to our competitive position by enabling our company to scale at a rapid pace. We have strong execution against our domestic growth strategy while continuing to launch new international markets and expanding our commercial brokerage business that lends well to our overall model.”

First Quarter 2021 Financial Results – Virtual Fireside Chat

The Company will hold a virtual fireside chat and investor Q&A session with eXp World Holdings Founder and CEO Glenn Sanford, CFO Jeff Whiteside, and President of U.S. Growth Dave Conord on Thursday, May 6, 2021 to discuss first quarter 2021 financial results and recent milestone achievements. Greg Falesnik, CEO of MZ North America, will moderate the discussion.

The investor Q&A is open to investors, current stockholders and anyone interested in learning more about eXp World Holdings and its platform.

Date: Thursday, May 6, 2021

Time: 2 p.m. PDT/ 5 p.m. EDT

Location: EXPI Campus. Join at https://devexpworld.wpengine.com/contact/download/

Livestream: devexpworld.wpengine.com/events

About eXp World Holdings, Inc.

eXp World Holdings, Inc. (Nasdaq: EXPI) is the holding company for eXp Realty, Virbela and SUCCESS Enterprises.

eXp World Holdings and its global brokerage, eXp Realty, is one of the fastest-growing real estate tech companies in the world with more than 53,000 agents in the United States, Canada, the United Kingdom, Australia, South Africa, India, Mexico, Portugal, France, Puerto Rico, Brazil, Italy, Hong Kong, and Colombia, and continues to scale internationally. As a publicly traded company, eXp World Holdings provides real estate professionals the unique opportunity to earn equity awards for production goals and contributions to overall company growth. eXp World Holdings and its businesses offer a full suite of brokerage and real estate tech solutions, including its innovative residential and commercial brokerage model, professional services, collaborative tools and personal development. The cloud-based brokerage is powered by an immersive 3D platform that is deeply social and collaborative, enabling agents to be more connected and productive.

For more information, visit https://devexpworld.wpengine.com.

Use of Non-GAAP Financial Measures

To provide investors with additional information regarding our financial results, this press release includes references to Adjusted EBITDA, which is a non-U.S. GAAP financial measure and may be different than similarly titled measures used by other companies. It is presented to enhance investors’ overall understanding of the company’s financial performance and should not be considered a substitute for, or superior to, the financial information prepared and presented in accordance with U.S. GAAP.

The company’s Adjusted EBITDA provides useful information about financial performance, enhances the overall understanding of past performance and future prospects, and allows for greater transparency with respect to a key metric used by management for financial and operational decision-making. Adjusted EBITDA helps identify underlying trends in the business that otherwise could be masked by the effect of the expenses that are excluded in Adjusted EBITDA. In particular, the company believes the exclusion of stock and stock option expenses, provides a useful supplemental measure in evaluating the performance of operations and provides better transparency into results of operations.

The company defines the non-U.S. GAAP financial measure of Adjusted EBITDA to mean net income (loss), excluding other income (expense), income tax benefit (expense), depreciation, amortization, and impairment charges; stock-based compensation expense, and stock option expense. Adjusted EBITDA may assist investors in seeing financial performance through the eyes of management, and may provide an additional tool for investors to use in comparing core financial performance over multiple periods with other companies in the industry.

Adjusted EBITDA should not be considered in isolation from, or as a substitute for, financial information prepared in accordance with U.S. GAAP. There are a number of limitations related to the use of Adjusted EBITDA compared to Net Income (Loss), the closest comparable U.S. GAAP measure. Some of these limitations are that:

- Adjusted EBITDA excludes stock-based compensation expense and stock option expense, which have been, and will continue to be for the foreseeable future, significant recurring expenses in the business and an important part of the compensation strategy; and

- Adjusted EBITDA excludes certain recurring, non-cash charges such as depreciation of fixed assets, amortization of acquired intangible assets, and impairment charges related to these long-lived assets, and, although these are non-cash charges, the assets being depreciated and amortized may have to be replaced in the future.

Safe Harbor Statement

The statements contained herein may include statements of future expectations and other forward-looking statements that are based on management’s current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. Such forward-looking statements speak only as of the date hereof, and the company undertakes no obligation to revise or update them. These statements include, but are not limited to, statements about the economic and social effects of the COVID-19 pandemic; continued growth of our agent and broker base; expansion of our residential real estate brokerage business into foreign markets; demand for remote working and distance learning solutions and virtual events; development of our new commercial brokerage and our ability to attract commercial real estate brokers; and revenue growth and financial performance. Such statements are not guarantees of future performance. Important factors that may cause actual results to differ materially and adversely from those expressed in forward-looking statements include changes in business or other market conditions; the difficulty of keeping expense growth at modest levels while increasing revenues; and other risks detailed from time to time in the company’s Securities and Exchange Commission filings, including but not limited to the most recently filed Quarterly Report on Form 10-Q and Annual Report on Form 10-K.

Media Relations Contact:

eXp World Holdings, Inc.

[email protected]

Investor Relations Contact:

MZ Group – MZ North America

[email protected]