BELLINGHAM, Wash. — July 31, 2024 — eXp World Holdings, Inc. (Nasdaq: EXPI), or the “Company”, the holding company for eXp Realty®, FrameVR.io and SUCCESS® Enterprises, today announced financial results for the second quarter ended June 30, 2024.

“The power of the eXp platform is paying off for our agents and eXp worldwide,” said Glenn Sanford, eXp World Holdings Founder, Chairman and CEO. “We believe the investments we’ve made to provide our agents with the best tools, technology and training during this downturn are helping them outpace the industry in productivity while increasing our agent NPS score. It’s clear that we have established the winning playbook for agents in the U.S. while our International segment is an untapped opportunity where I have taken a more active role guiding our ongoing growth. Moving forward, we will continue to relentlessly pursue our core objective of being the most agent-centric real estate brokerage on the planet.”

“After gathering feedback from agents during my first quarter as eXp Realty CEO, it is clear that our initiatives to support agent productivity are gaining traction,” said Leo Pareja, eXp Realty CEO. “Agents love the expanded learning and development options, faster payouts and Gen AI-based self-service capabilities we have introduced, and they are eager for what’s to come. I remain committed to seeking new ways to leverage technology to operate more efficiently, which will both fund our investments in agent productivity and drive agent satisfaction as increasingly automated processes enable agents to devote more of their time to serving their clients.”

“We delivered a solid second quarter as eXp agents closed $52 billion of transactions, a 7% year-over-year increase, and grew revenues 5% year-over-year while generating significant cash flow and returning $56 million to shareholders through share repurchases and cash dividends,” said Kent Cheng, Chief Accounting Officer of eXp World Holdings. “We continue to improve business efficiencies and reduce costs, even while investing aggressively in our agents. We believe this winning formula will drive superior growth and greater value for our shareholders over the long term.”

Second Quarter 2024 Consolidated Financial Highlights as Compared to the Same Year-Ago Period:

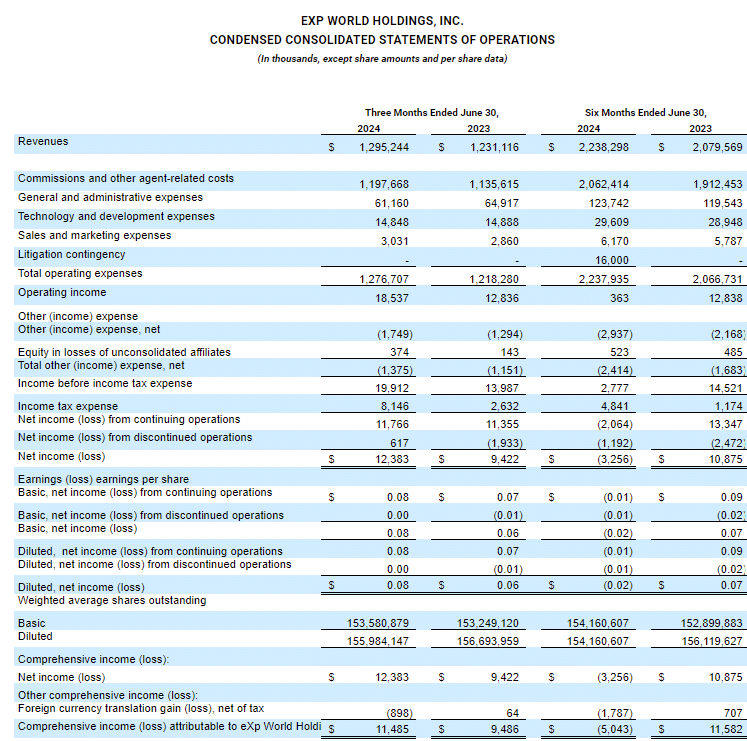

- Second quarter revenue increased 5% to $1,295 million, driven by the superior productivity of our agents, which more than offset declines in the U.S. real estate market, as well as increased home sales prices. U.S. transaction units outperformed the market.

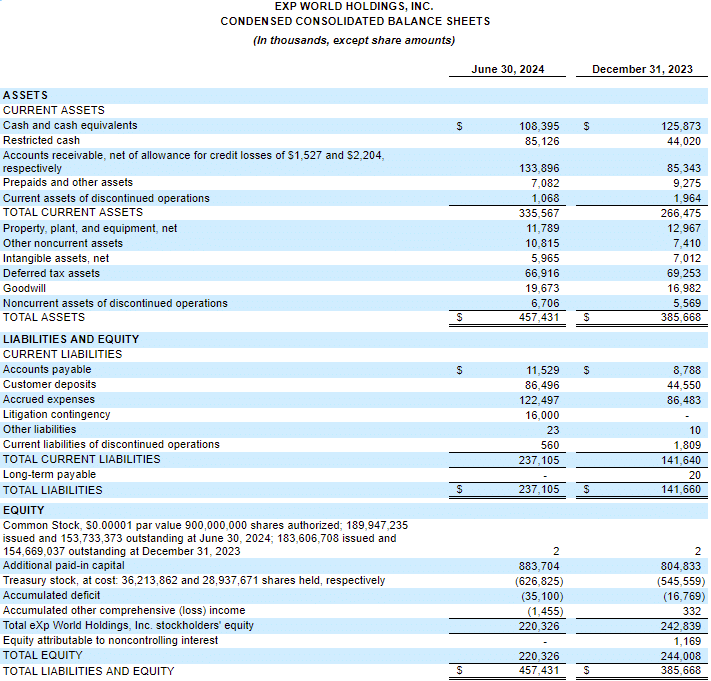

- Second quarter net income from continuing operations of $11.8 million compared to $11.4 million net income in the second quarter of 2023. In spite of a 44% increase of operating income, net income is impacted unfavorably by higher tax on continuing operations. Second quarter net income from continuing operations per diluted share of $0.08 compared to net income per diluted share of $0.07 in the year-ago quarter. Second quarter net income including discontinued operations was $12.4 million compared to $9.4 million in the second quarter of 2023.

- Second quarter operating costs were $79.0 million, a 4% decrease compared to the second quarter of 2023. This decrease was driven by lower expenses related to the shareholders summit in 2024, since it was conducted virtually, and lower employee-related expenses, partially offset by increased legal expenses associated with the antitrust lawsuit.

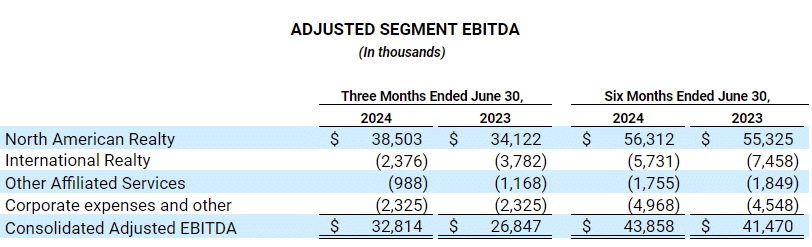

- Second quarter adjusted EBITDA (a non-GAAP financial measure) of $32.8 million, an increase of 22% compared to the second quarter of 2023. Adjusted EBITDA was higher year over year, due to improved business efficiencies, reduced costs, and higher revenues and gross profit.

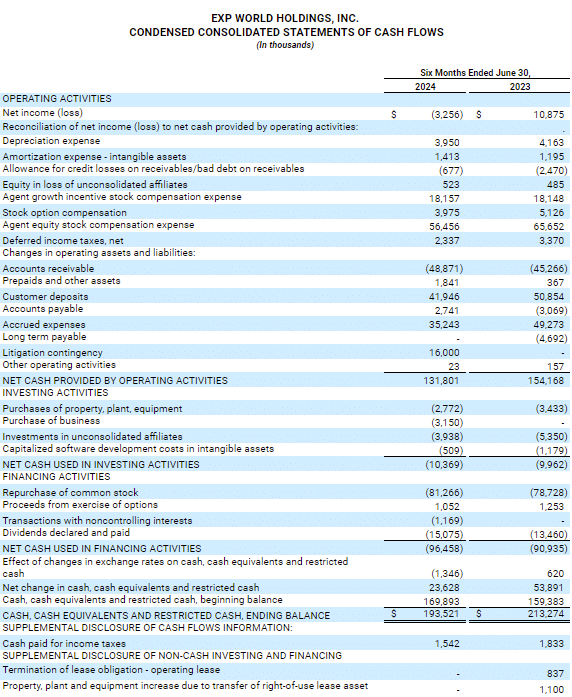

- As of June 30, 2024, cash and cash equivalents totaled $108.4 million, compared to $124.7 million as of June 30, 2023. The Company repurchased approximately $48.2 million of common stock during the second quarter of 2024.

- The Company paid a cash dividend for the second quarter of 2024 of $0.05 per share of common stock on May 27, 2024. On July 26, 2024, the Company’s Board of Directors declared a cash dividend of $0.05 per share of common stock for the third quarter of 2024, expected to be paid on August 30, 2024 to stockholders of record on August 14, 2024.

Second Quarter 2024 Operational Highlights as Compared to the Same Year-Ago Period:

- eXp ended the second quarter of 2024 with a global agent Net Promoter Score (aNPS) of 76, up from 72 a year ago. aNPS is a measure of agent satisfaction and an important key performance indicator (KPI) given the Company’s intense focus on improving the agent experience.

- Agents and brokers on the eXp Realty platform decreased 1% year-over-year to 87,111 as of June 30, 2024 as we continue to off board less productive agents. However, we are committed to retaining our most productive agents in the United States and Canada through the execution of our growth strategies and the end-to-end suite of services we offer our agents.

- Real estate sales transactions increased 1% year-over-year to 120,613.

- Transaction volume increased 7% year-over-year to $51.9 billion.

- Launched eXp Elevate Coaching, a state-of-the-art coaching platform designed to enhance the business growth and professional development of eXp Realty agents in North America.

- Launched the Global Agent Referral Platform, designed to simplify and accelerate the real estate referral process.

- Announced 44 eXp Realty agents named to the 2024 RealTrends + Tom Ferry The Thousand List, an annual, national program that ranks the top 500 agents and top 500 teams in the U.S. by transaction sides and sales volume.

Second Quarter 2024 Results – Virtual Fireside Chat

The Company will hold a virtual fireside chat and investor Q&A with eXp World Holdings Founder and CEO Glenn Sanford, eXp Realty CEO Leo Pareja and eXp World Holdings Chief Accounting Officer, Kent Cheng on Wednesday, July 31, 2024 at 2 p.m. PT / 5 p.m. ET.

The investor Q&A is open to investors, current stockholders and anyone interested in learning more about eXp World Holdings and its companies. Submit questions in advance for inclusion to [email protected].

Date: Wednesday, July 31, 2024

Time: 2 p.m. PT / 5 p.m. ET

Location: exp.world. Join at https://exp.world/earnings

Livestream: expworldholdings.com/events

About eXp World Holdings, Inc.

eXp World Holdings, Inc. (Nasdaq: EXPI) is the holding company for eXp Realty®, FrameVR.io and SUCCESS® Enterprises.

eXp Realty is the largest independent real estate company in the world with more than 87,000 agents in the United States, Canada, the United Kingdom, Australia, France, India, Mexico, Portugal, South Africa, Puerto Rico, Brazil, Italy, Hong Kong, Colombia, Spain, Israel, Panama, Germany, the Dominican Republic, Greece, New Zealand, Chile, Poland and Dubai and continues to scale internationally. As a publicly traded company, eXp World Holdings provides real estate professionals the unique opportunity to earn equity awards for production goals and contributions to overall company growth. eXp World Holdings and its businesses offer a full suite of brokerage and real estate tech solutions, including an innovative residential and commercial brokerage model, professional services, collaborative tools and personal development. The cloud-based brokerage is powered by FrameVR.io technology, offering immersive 3D platforms that are deeply social and collaborative, enabling agents to be more connected and productive. SUCCESS® Enterprises, anchored by SUCCESS® magazine and its related media properties, was established in 1897 and is a leading personal and professional development brand and publication.

For more information, visit https://expworldholdings.com.

eXp World Holdings, Inc. intends to use its Investor Relations website, its X (formerly Twitter) feed (@eXpWorldIR), Facebook page (https://www.facebook.com/eXpWorldHoldings), Instagram account (@eXpWorldHoldings), LinkedIn page (https://www.linkedin.com/company/expworldholdings/), as well as eXp Realty, LLC’s X (formerly Twitter) feed (@eXpRealty), Facebook page (https://www.facebook.com/eXpRealty), Instagram account (@eXpRealty_), and LinkedIn account (https://www.linkedin.com/company/exp-realty/) as a means of disclosing material non-public information and to comply with its disclosure obligations under Regulation FD.

Use of Non-GAAP Financial Measures

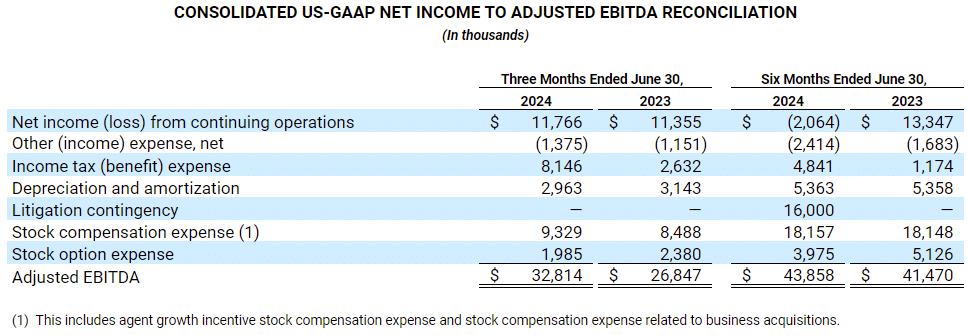

To provide investors with additional information regarding our financial results, this press release includes references to adjusted EBITDA, which is a non-U.S. GAAP financial measure that may be different from similarly titled measures used by other companies. This measure is presented to enhance investors’ overall understanding of the Company’s financial performance and should not be considered a substitute for, or superior to, the financial information prepared and presented in accordance with U.S. GAAP.

The Company’s non-GAAP financial measure provides useful information about financial performance, enhances the overall understanding of past performance and future prospects, and allows for greater transparency with respect to key metrics used by management for financial and operational decision-making. This measure may also provide additional tools for investors to use in comparing core financial performance over multiple periods with other companies in the industry.

- Adjusted EBITDA helps identify underlying trends in the business that could otherwise be masked by the effect of the expenses excluded in adjusted EBITDA. In particular, the Company believes the exclusion of stock and stock option expenses provides a useful supplemental measure in evaluating the performance of operations and provides better transparency into results of operations. The Company defines adjusted EBITDA to mean net income (loss) from continuing operations, excluding other income (expense), income tax benefit (expense), depreciation, amortization, impairment charges, litigation contingency expenses, stock-based compensation expense, and stock option expense.

Adjusted EBITDA should not be considered in isolation from, or as a substitute for, financial information prepared in accordance with U.S. GAAP.

Safe Harbor Statement

The statements contained herein may include statements of future expectations and other forward-looking statements that are based on management’s current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. These statements include, but are not limited to, statements about future cost saving measures; the continued growth of our agent and broker base; improvements in technology and operational processes; revenue growth; dividends; and financial performance. Such forward-looking statements speak only as of the date hereof, and the Company undertakes no obligation to revise or update them. Such statements are not guarantees of future performance. Important factors that may cause actual results to differ materially and adversely from those expressed in forward-looking statements include changes in business or other market conditions; outcomes of ongoing litigation; the difficulty of keeping expense growth at modest levels while increasing revenues; and other risks detailed from time to time in the Company’s Securities and Exchange Commission filings, including but not limited to the most recently filed Quarterly Report on Form 10-Q and Annual Report on Form 10-K.

Media Relations Contact:

eXp World Holdings, Inc.

[email protected]

Investor Relations Contact:

Denise Garcia

[email protected]

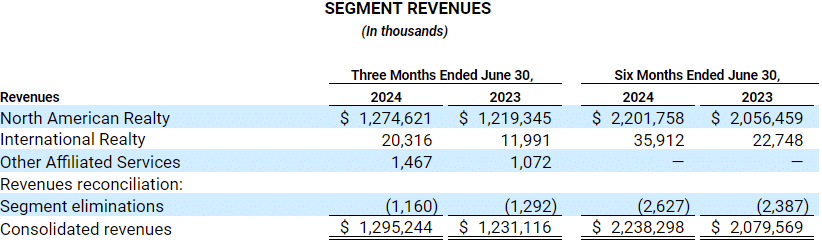

The following tables reflects Revenues and Adjusted Segment EBITDA by reportable segments:

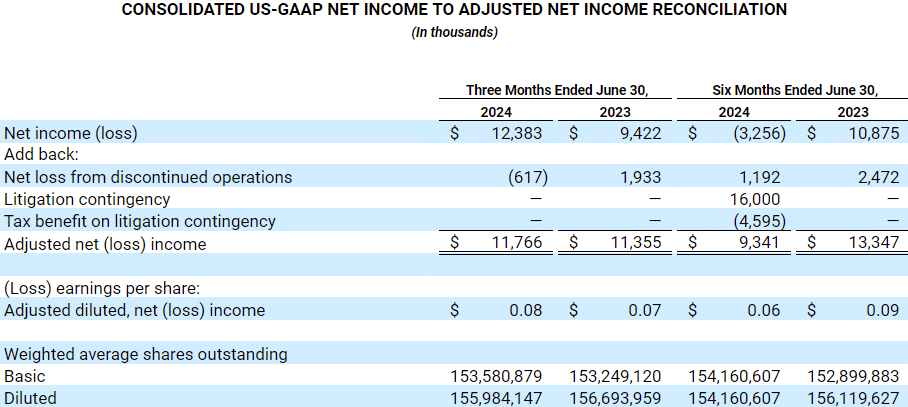

The following table reflects Adjusted Net Income: