eXp World Holdings Reports Q3 2023 Results

Agent Count Grew 5% Compared to Q3 2022 to More Than 89,000 Agents in 24 Global Markets

International Realty Revenue Increased 47% Compared to Q3 2022 to an All-Time Record

Company Declares Cash Dividend for Q4 2023 of $0.05 per Share of Common Stock

BELLINGHAM, Wash. — Nov. 2, 2023 — eXp World Holdings, Inc. (Nasdaq: EXPI), or the “Company”, the holding company for eXp Realty®, Virbela and SUCCESS® Enterprises, today announced financial results for the third quarter ended Sept. 30, 2023.

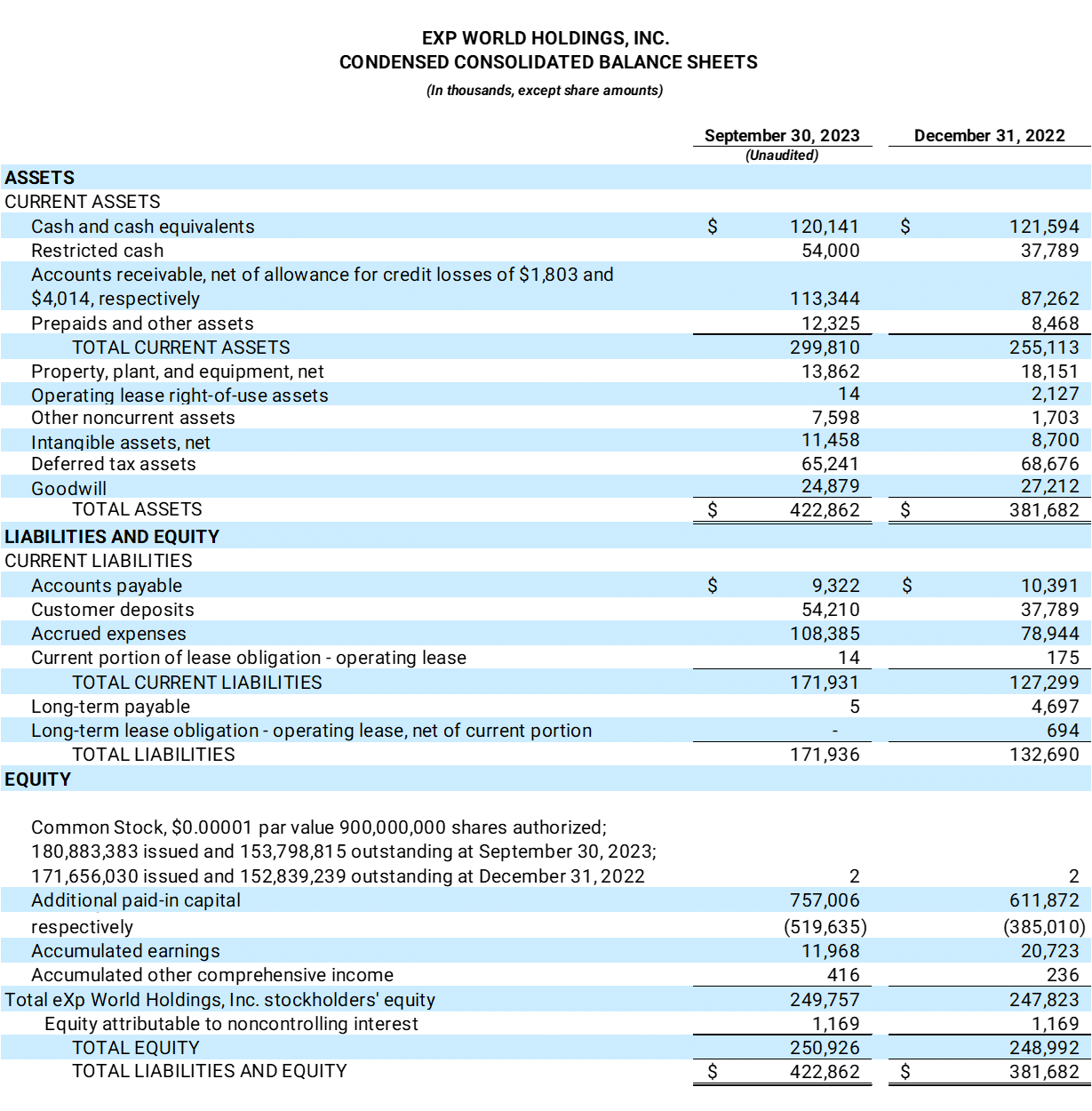

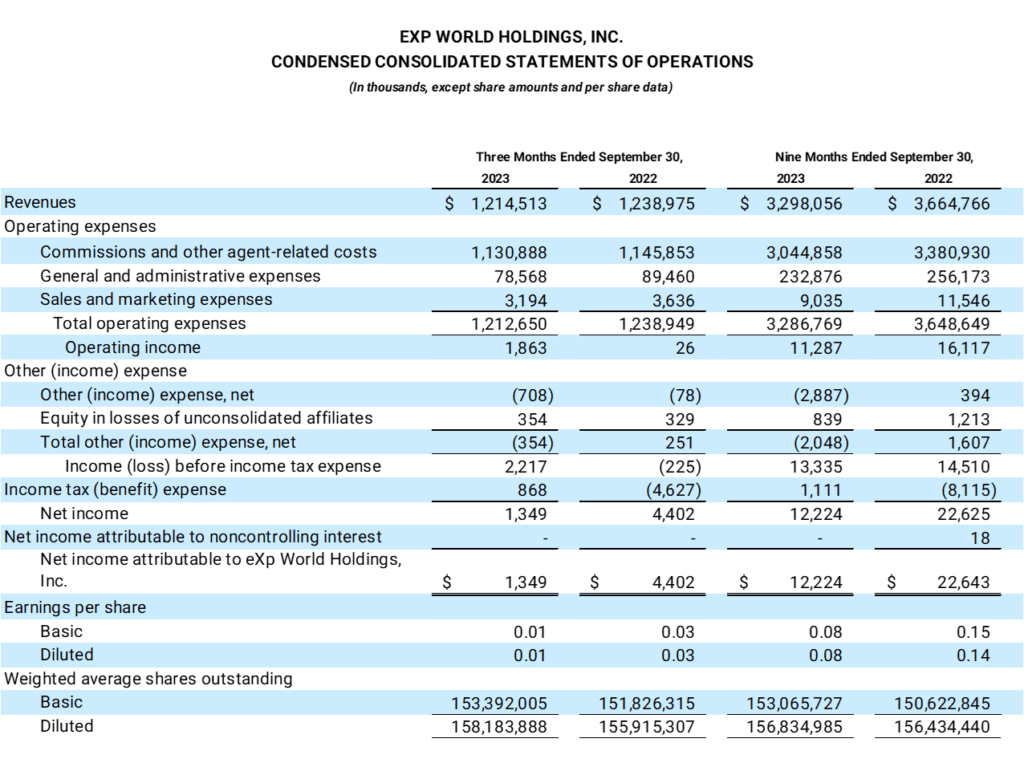

Third Quarter 2023 Consolidated Financial Highlights as Compared to the Same Year-Ago Quarter:

-

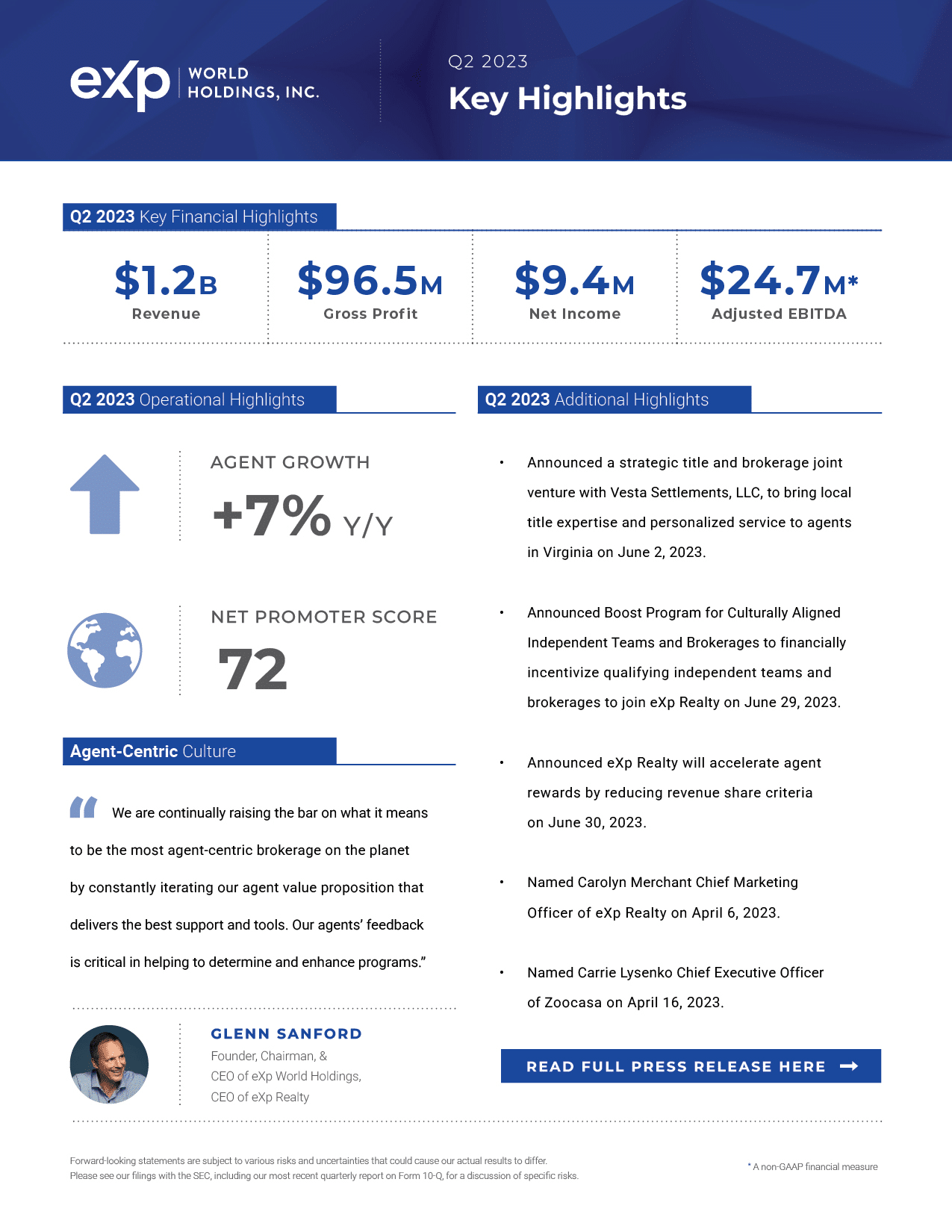

- Revenue decreased 2% to $1.2 billion.

- Gross profit decreased 10% to $83.6 million.

- Net income of $1.3 million. Earnings per diluted share of $0.01 compared to earnings per diluted share of $0.03 in the year-ago quarter.

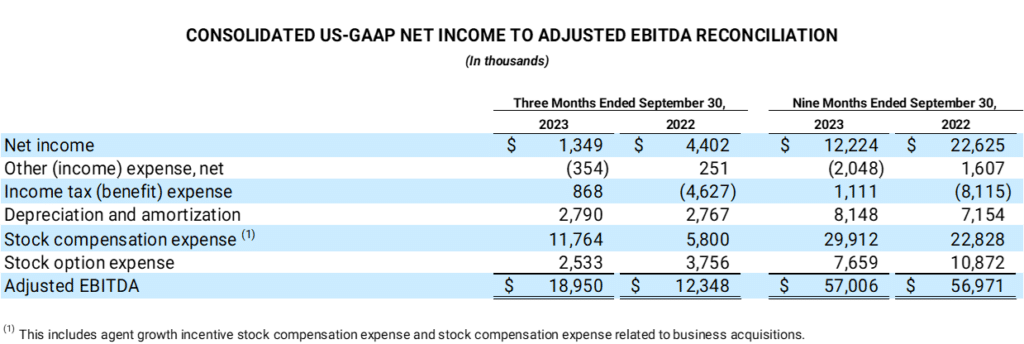

- Adjusted EBITDA (a non-GAAP financial measure) increased 53% to $19.0 million.

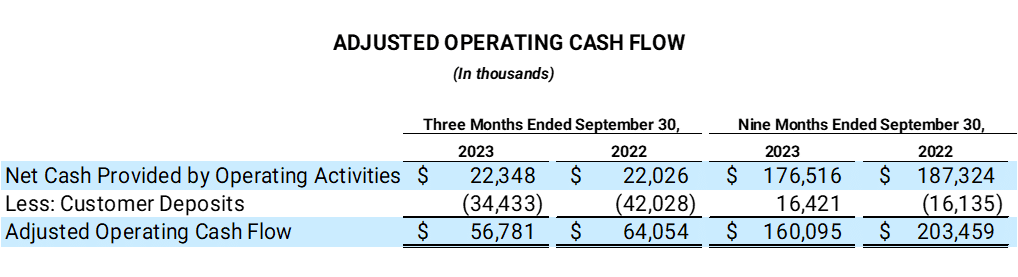

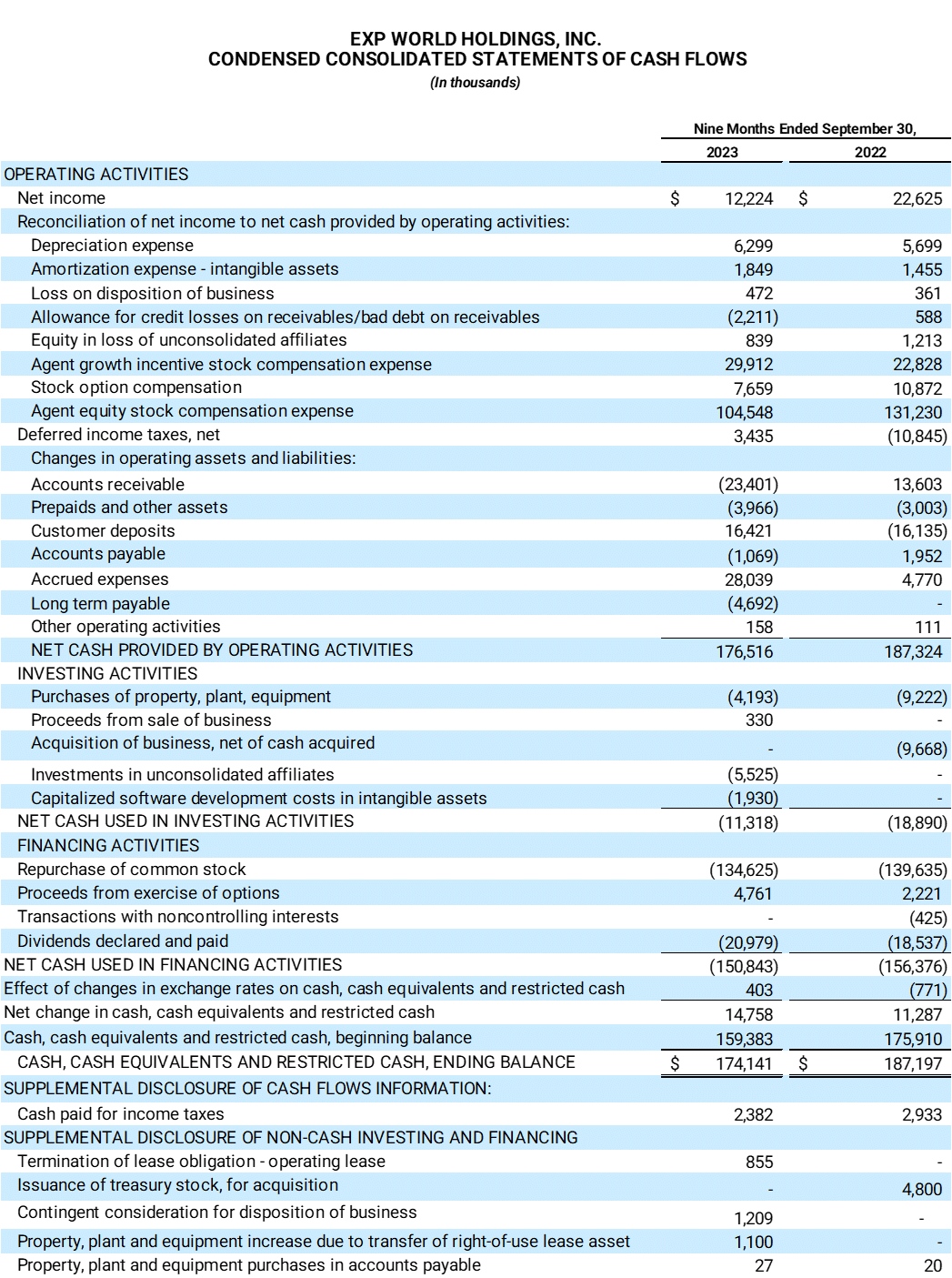

- Generated $56.8 million of Adjusted Operating Cash Flow (a non-GAAP financial measure).

- As of Sept. 30, 2023, cash and cash equivalents totaled $120.1 million, compared to $121.6 million as of Dec. 31, 2022. The Company repurchased approximately $55.9 million of common stock during the third quarter of 2023.

- The Company paid a cash dividend for the third quarter of 2023 of $0.05 per share of common stock on Sept. 4, 2023. On Oct. 25, 2023, the Company’s Board of Directors declared a cash dividend of $0.05 per share of common stock for the fourth quarter of 2023, expected to be paid on Nov. 30, 2023 to stockholders of record on Nov. 16, 2023.

Management Commentary

“During the third quarter, we continued to focus on agent-centric innovation that drove meaningful results, as we once again increased eXp’s agent Net Promoter Score (aNPS) while extending our market share gains,” said Glenn Sanford, Founder, Chairman and CEO of eXp World Holdings. “In a slower market environment where every transaction counts, eXp’s agents in the U.S. significantly outperformed the market during the third quarter. This outstanding performance speaks to the differentiated nature of eXp’s platform and the power of our unique, success-oriented culture.

“Moving forward, we see many opportunities to further iterate on our agent-centric value proposition with programs like Boost, Accelerate, Thrive, and eXp exclusives and partnerships with Opendoor and the HomeRiver Group. Internationally, we recently announced a partnership with HomeHunter Global. All of this ultimately empowers our agents to spend more of their time on revenue-generating opportunities. We continue to believe that our investments in agent success are the key to driving superior growth over the long term.”

“We delivered solid financial performance during the third quarter, with year-over-year Adjusted EBITDA growth of 53% despite challenging market conditions as we continued to improve the efficiency of our operations,” said Jeff Whiteside, CFO and Chief Collaboration Officer of eXp World Holdings. “We once again gained market share, despite lower market activity due to elevated mortgage rates, which resulted in decreased transaction value compared to the prior year quarter.

“While we continue to prudently manage expenses, our strong cash flow profile enables us to simultaneously pursue an ambitious and innovative agent-centric agenda while allocating capital to our shareholders through share repurchases and cash dividends. By continuing to invest in our agents through the current market cycle, we are building a strong foundation for accelerated growth and continued share gains despite fluctuations in the market.”

Third Quarter 2023 Operational Highlights as Compared to the Same Year-Ago Period:

-

-

- eXp Realty ended the third quarter of 2023 with a global agent Net Promoter Score of 74, up from 71 a year ago. NPS is a measure of agent satisfaction and an important key performance indicator (KPI) given the Company’s intense focus on improving the agent experience.

- Agents and brokers on the eXp Realty platform increased 5% to 89,156 as of Sept. 30, 2023.

- Transactions increased 1% to 139,480.

- Transaction volume decreased 4% to $48.5 billion.

- Announced the first brokerage, The Bean Group, to join eXp Realty through the Boost program on Sept. 12, 2023.

- Hosted the inaugural EXPCON Canada, the Company’s first signature event held outside the United States, on Sept. 6-8, 2023.

- Announced the expansion of its partnership with Realty.com into Canada with the launch of Realty.ca on Sept. 7, 2023.

- Appointed Bain Fellow and NPS creator Fred Reichheld to the eXp World Holdings Board of Directors on Sept. 7, 2023.

- Announced eXp Realty exceeded the 1,000-agent milestone in South Africa on Aug. 10, 2023.

- Launched eXp Luxury Division in Canada on Sept. 7, 2023.

-

Third Quarter 2023 Results – Virtual Fireside Chat

The Company will hold a virtual fireside chat and investor Q&A with eXp World Holdings Founder and CEO Glenn Sanford and CFO Jeff Whiteside on Thursday, Nov. 2, 2023 at 2 p.m. PT / 5 p.m. ET.

The investor Q&A is open to investors, current shareholders and anyone interested in learning more about eXp World Holdings and its companies. Submit questions in advance for inclusion to [email protected].

Date: Thursday, Nov. 2, 2023

Time: 2 p.m. PT / 5 p.m. ET

Location: EXPI Campus. Join at https://expworldholdings.com/contact/download/

Livestream: expworldholdings.com/events

About eXp World Holdings, Inc.

eXp World Holdings, Inc. (Nasdaq: EXPI) is the holding company for eXp Realty®, Virbela and SUCCESS® Enterprises.

eXp Realty is the largest independent real estate company in the world with more than 89,000 agents in the United States, Canada, the United Kingdom, Australia, South Africa, India, Mexico, Portugal, France, Puerto Rico, Brazil, Italy, Hong Kong, Colombia, Spain, Israel, Panama, Germany, Dominican Republic, Greece, New Zealand, Chile, Poland and Dubai and continues to scale internationally. As a publicly traded Company, eXp World Holdings provides real estate professionals the unique opportunity to earn equity awards for production goals and contributions to overall Company growth. eXp World Holdings and its businesses offer a full suite of brokerage and real estate tech solutions, including its innovative residential and commercial brokerage model, professional services, collaborative tools and personal development. The cloud-based brokerage is powered by Virbela, an immersive 3D platform that is deeply social and collaborative, enabling agents to be more connected and productive. SUCCESS® Enterprises, anchored by SUCCESS® magazine and its related media properties, was established in 1897 and is a leading personal and professional development brand and publication.

For more information, visit https://expworldholdings.com.

Use of Non-GAAP Financial Measures

To provide investors with additional information regarding our financial results, this press release includes references to Adjusted EBITDA and Adjusted Operating Cash Flow, which are non-U.S. GAAP financial measures that may be different than similarly titled measures used by other companies. These measures are presented to enhance investors’ overall understanding of the Company’s financial performance and should not be considered a substitute for, or superior to, the financial information prepared and presented in accordance with U.S. GAAP.

The Company’s Adjusted EBITDA provides useful information about financial performance, enhances the overall understanding of past performance and future prospects, and allows for greater transparency with respect to a key metric used by management for financial and operational decision-making. Adjusted EBITDA helps identify underlying trends in the business that otherwise could be masked by the effect of the expenses that are excluded in Adjusted EBITDA. In particular, the Company believes the exclusion of stock and stock option expenses provides a useful supplemental measure in evaluating the performance of operations and provides better transparency into results of operations.

The Company defines the non-U.S. GAAP financial measure of Adjusted EBITDA to mean net income (loss), excluding other income (expense), income tax benefit (expense), depreciation, amortization, impairment charges, stock-based compensation expense, and stock option expense. The Company defines the non-U.S. GAAP financial measure of Adjusted Operating Cash Flow to mean net cash provided by operating activities, excluding the change in customer deposits. Adjusted EBITDA and Adjusted Operating Cash Flow may assist investors in seeing financial performance through the eyes of management, and may provide an additional tool for investors to use in comparing core financial performance over multiple periods with other companies in the industry.

Adjusted EBITDA and Adjusted Operating Cash Flow should not be considered in isolation from, or as a substitute for, financial information prepared in accordance with U.S. GAAP. There are a number of limitations related to the use of Adjusted EBITDA compared to Net Income (loss), the closest comparable U.S. GAAP measure. Some of these limitations are:

-

- Adjusted EBITDA excludes stock-based compensation expense and stock option expense, which have been, and will continue to be for the foreseeable future, significant recurring expenses in the business and an important part of the compensation strategy; and

- Adjusted EBITDA excludes certain recurring, non-cash charges such as depreciation of fixed assets, amortization of acquired intangible assets, and impairment charges related to these long-lived assets, and, although these are non-cash charges, the assets being depreciated and amortized may have to be replaced in the future.

Safe Harbor Statement

The statements contained herein may include statements of future expectations and other forward-looking statements that are based on management’s current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. These statements include, but are not limited to, statements about the continued growth of our agent and broker base; engagement in third party affiliations; improvements in technology and operational processes; expansion of our residential real estate brokerage business into foreign markets; revenue growth; share repurchases; dividends; and financial performance. Such forward-looking statements speak only as of the date hereof, and the Company undertakes no obligation to revise or update them. Such statements are not guarantees of future performance. Important factors that may cause actual results to differ materially and adversely from those expressed in forward-looking statements include changes in business or other market conditions; the difficulty of keeping expense growth at modest levels while increasing revenues; and other risks detailed from time to time in the Company’s Securities and Exchange Commission filings, including but not limited to the most recently filed Quarterly Report on Form 10-Q and Annual Report on Form 10-K.

Media Relations Contact:

eXp World Holdings, Inc.

[email protected]

Investor Relations Contact:

Denise Garcia

[email protected]

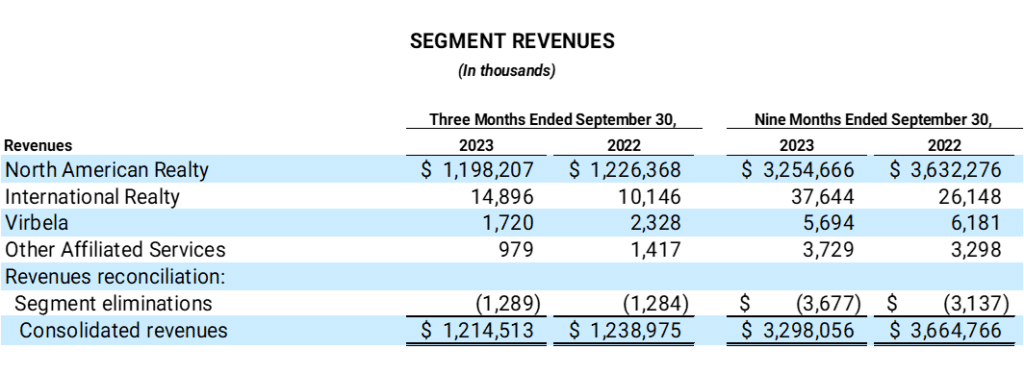

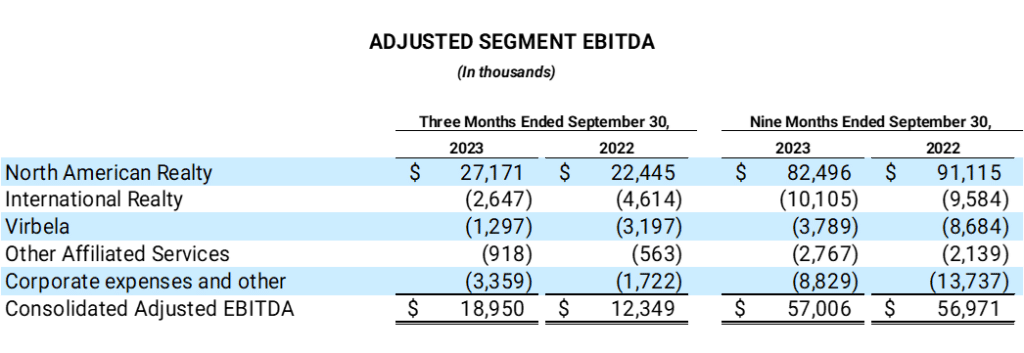

The following tables reflects Revenues and Adjusted Segment EBITDA by reportable segments: