BELLINGHAM, Wash. — Nov. 07, 2024 — eXp World Holdings, Inc. (Nasdaq: EXPI), or the “Company”, the holding company for eXp Realty®, FrameVR.io and SUCCESS® Enterprises, today announced financial results for the third quarter ended Sept. 30, 2024.

“This is an exciting and pivotal time for eXp agents worldwide,” said Glenn Sanford, eXp World Holdings Founder, Chairman and CEO. “We continue to operate the most innovative, agent-centric real estate brokerage on the planet, improving the agent value proposition by leveraging technology like generative AI to help eXp agents and employees work faster, better and smarter. Our competitive value proposition and continued strong agent NPS score indicate we are well-positioned for success as the market begins to turn. Worldwide, we continue to unlock the international opportunities by supporting tools like HomeHunter.global and our expected upcoming expansion of the eXp Realty model into Türkiye, Peru, and Egypt markets that we announced at eXpcon last week.”

“We are thrilled to announce that eXp Realty welcomed several high-achieving independent brokerages and agent teams to our platform in the third quarter,” said Leo Pareja, CEO of eXp Realty. “Leading independent brokerages, recognized as powerhouses in their regions, are choosing eXp to accelerate their growth and maximize their earnings potential. Our innovative business model and exceptional value proposition set us apart in the industry, and our strategic investments in cutting-edge programs and technology make eXp an incredibly attractive option for independent brokerages. By joining eXp, they gain access to resources and support that would be prohibitively expensive to develop independently.”

“In the third quarter, we increased our margins and profitability, despite a continued challenging market, demonstrating the strength and sustainability of our business model,” stated Kent Cheng, Principal Financial Officer and Chief Accounting Officer of eXp World Holdings. “Simultaneously, we are committed to investing in our agents by hosting inspiring events like eXpcon in the fourth quarter and continuing to lead the industry in agent technology innovations.”

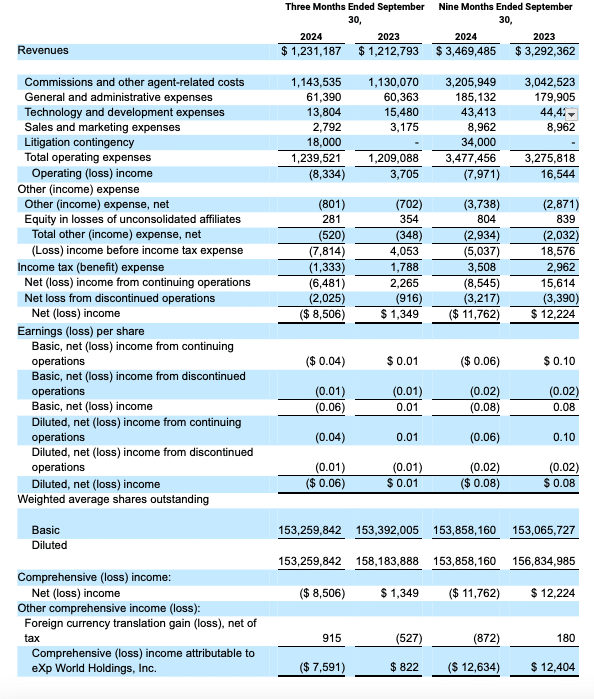

Third Quarter 2024 Consolidated Financial Highlights as Compared to the Same Year-Ago Period:

- Third quarter revenue increased 2% to $1.2 billion, driven by increased home sales prices and the superior productivity of our agents.

- Third quarter net (loss) income from continuing operations of ($6.5 million) compared to net income of $2.3 million in the third quarter of 2023. Net income was impacted unfavorably by an $18.0 million litigation contingency provision related to the antitrust settlement. Third quarter net (loss) income from continuing operations per diluted share of ($0.04) compared to $0.01 in the year-ago quarter.

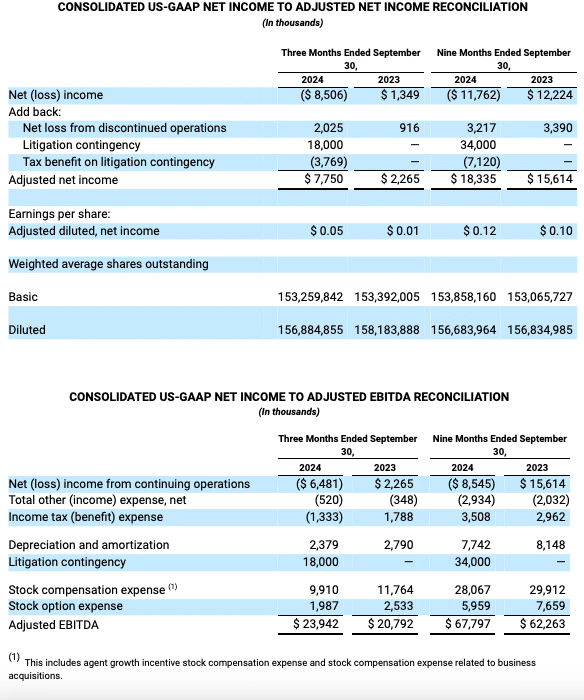

- Third quarter adjusted net income (a non-GAAP financial measure) excluding antitrust litigation contingency provision and discontinued operations was $7.8 million compared to adjusted net income of $2.3 million in the year-ago quarter. Third quarter adjusted net income per diluted share of $0.05 compared to adjusted $0.01 in the third quarter of 2023.

- Third quarter adjusted operating costs (a non-GAAP financial measure) were $78.0 million, a 1% decrease compared to the third quarter of 2023. This decrease was driven by lower technology and development expenses and lower sales and marketing expenses, partially offset by increased legal expenses associated with the antitrust lawsuit.

- Third quarter adjusted EBITDA(a non-GAAP financial measure) of $23.9 million, an increase of 15% compared to the third quarter of 2023. Adjusted EBITDA was higher year over year, due to improved business efficiencies, reduced costs, and higher revenues and gross profit.

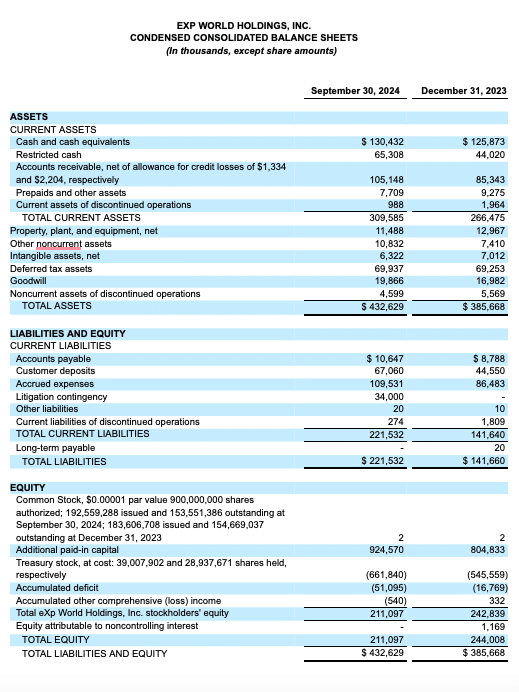

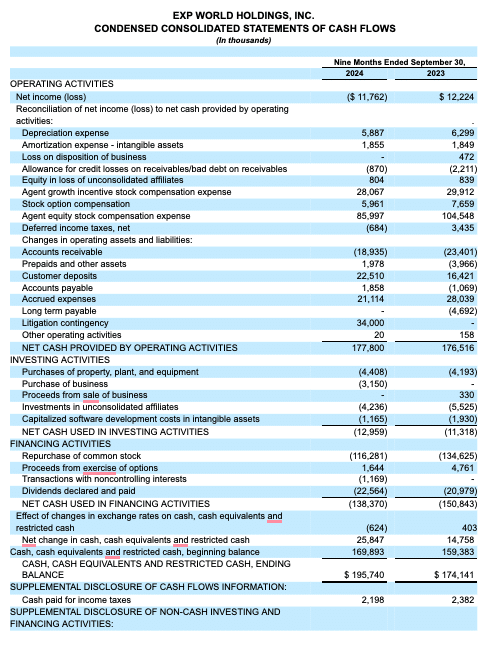

- As of Sept. 30, 2024, cash and cash equivalents totaled $130.4 million, compared to $120.4 million in the year-ago quarter. The Company repurchased approximately $35.0 million of common stock during the third quarter of 2024.

- The Company paid a cash dividend for the third quarter of 2024 of $0.05 per share of common stock on Aug. 30, 2024. On Nov. 4, 2024, the Company’s Board of Directors declared a cash dividend of $0.05 per share of common stock for the fourth quarter of 2024, expected to be paid on Dec. 2, 2024 to stockholders of record on Nov. 18, 2024.

Third Quarter 2024 Operational Highlights as Compared to the Same Year-Ago Period:

- eXp ended the third quarter of 2024 with a global agent Net Promoter Score (aNPS) of 76, up from 74 a year ago. aNPS is a measure of agent satisfaction and an important key performance indicator (KPI) given the Company’s intense focus on improving the agent experience.

- Agents and brokers on the eXp Realty platform decreased 4% year-over-year to 85,249 as of Sept. 30, 2024 as we continue to off-board less productive agents. However, we are committed to retaining our most productive agents in the United States and Canada through the execution of our growth strategies and the end-to-end suite of services we offer our agents.

- Real estate sales transactions decreased 1% year-over-year to 117,830.

- Transaction volume increased 5% year-over-year to $50.8 billion.

- Welcomed several independent brokerage teams to eXp Realty, including:

- Matt Fetick Team, previously ranked No. 87 nationally with Keller Williams. On the 2024 RealTrends The Thousand rankings, the Matt Fetick Team was No. 132 among Large Teams by Sides and No. 163 on the Large Teams by Volume list, with 244 sides and nearly $116 million in volume.

- Delhougne Realty Group, a leading independent brokerage in St. Louis. In 2023, the Delhougne Realty Group achieved a remarkable $353,330,000 in sales volume with 1,160 transactions, earning over 2,000 5-star reviews on Zillow.

- Polsinello Team, with 25 highly skilled agents, achieved 218 closed transactions totaling $213 million in volume in 2023.

- The Bryce Hansen Team, a leading real estate team based in the Comox Valley on Vancouver Island, has consistently delivered outstanding results, including nearly $178.5 million in closed sales in 2023 alone.

- Brandon Brittingham, a leading force in Maryland’s real estate scene, has moved his 30-person team to eXp Realty.

- Grand Lux Realty based in Westchester County, the lower Hudson Valley and Fairfield County, Connecticut. With over 200 agents, Grand Lux Realty expects to exceed $100 million in annual sales and set new industry standards by joining forces with eXp Realty.

- CanZell Realty, a multimillion-dollar independent brokerage, operates across 20 states and is renowned for its client-first approach and commitment to giving back.

- Launched Groups Within eXp Commercial for Unmatched Advisor Collaboration and Streamlined Deals.

- Named Donald Cherry Vice President of Sustainability.

Subsequent Events Highlights:

- On Oct. 1, 2024, eXp World Holdings entered into a settlement term sheet to pay $34.0 million to settle various industry class-action lawsuits on a nationwide basis. The settlement would release the Company, its subsidiaries and affiliates, and their independent contractor real estate agents in the U.S. from the associated claims. The proposed settlement remains subject to preliminary and final court approval and will become effective only upon such final approval.

Third Quarter 2024 Results – Virtual Fireside Chat

The Company will hold a virtual fireside chat and investor Q&A with eXp World Holdings Founder and Chief Executive Officer Glenn Sanford; eXp Realty Chief Executive Officer Leo Pareja; eXp World Holdings Principal Financial Officer and Chief Accounting Officer Kent Cheng; Chief Marketing Officer Wendy Forsythe; and Chief Innovation Officer Seth Siegler on Thursday, Nov. 7, 2024 at 2 p.m. PT / 5 p.m. ET.

The investor Q&A is open to investors, current stockholders and anyone interested in learning more about eXp World Holdings and its companies. Submit questions in advance for inclusion to [email protected].

Date: Thursday, Nov. 7, 2024

Time: 2 p.m. PT / 5 p.m. ET

Location: exp.world. Join at https://exp.world/earnings

Livestream: expworldholdings.com/events

About eXp World Holdings, Inc.

eXp World Holdings, Inc. (Nasdaq: EXPI) is the holding company for eXp Realty®, FrameVR.io and SUCCESS® Enterprises.

eXp Realty is the largest independent real estate company in the world with more than 85,000 agents in the United States, Canada, the United Kingdom, Australia, France, India, Mexico, Portugal, South Africa, Puerto Rico, Brazil, Italy, Hong Kong, Colombia, Spain, Israel, Panama, Germany, the Dominican Republic, Greece, New Zealand, Chile, Poland and Dubai and continues to scale internationally. As a publicly traded company, eXp World Holdings provides real estate professionals the unique opportunity to earn equity awards for production goals and contributions to overall company growth. eXp World Holdings and its businesses offer a full suite of brokerage and real estate tech solutions, including an innovative residential and commercial brokerage model, professional services, collaborative tools and personal development. The cloud-based brokerage is powered by FrameVR.io technology, offering immersive 3D platforms that are deeply social and collaborative, enabling agents to be more connected and productive. SUCCESS® Enterprises, anchored by SUCCESS® magazine and its related media properties, was established in 1897 and is a leading personal and professional development brand and publication.

For more information, visit https://expworldholdings.com.

eXp World Holdings, Inc. intends to use its Investor Relations website, its X (formerly Twitter) feed (@eXpWorldIR), Facebook page (https://www.facebook.com/eXpWorldHoldings), Instagram account (@eXpWorldHoldings), LinkedIn page (https://www.linkedin.com/company/expworldholdings/), as well as eXp Realty, LLC’s X (formerly Twitter) feed (@eXpRealty), Facebook page (https://www.facebook.com/eXpRealty), Instagram account (@eXpRealty_), and LinkedIn account (https://www.linkedin.com/company/exp-realty/) as a means of disclosing material non-public information and to comply with its disclosure obligations under Regulation FD.

Use of Non-GAAP Financial Measures

To provide investors with additional information regarding our financial results, this press release includes references to adjusted EBITDA, adjusted net income, and adjusted operating costs which are non-U.S. GAAP financial measures that may be different from similarly titled measures used by other companies. These measures are presented to enhance investors’ overall understanding of the Company’s financial performance and should not be considered a substitute for, or superior to, the financial information prepared and presented in accordance with U.S. GAAP.

The Company’s non-GAAP financial measure provides useful information about financial performance, enhances the overall understanding of past performance and future prospects, and allows for greater transparency with respect to key metrics used by management for financial and operational decision-making. This measure may also provide additional tools for investors to use in comparing core financial performance over multiple periods with other companies in the industry.

- Adjusted EBITDA helps identify underlying trends in the business that could otherwise be masked by the effect of the expenses excluded in adjusted EBITDA. In particular, the Company believes the exclusion of stock and stock option expenses provides a useful supplemental measure in evaluating the performance of operations and provides better transparency into results of operations. The Company defines adjusted EBITDA to mean net income (loss) from continuing operations, excluding other income (expense), income tax benefit (expense), depreciation, amortization, impairment charges, litigation contingency expenses, stock-based compensation expense, and stock option expense.

- Adjusted net income helps identify underlying trends in the business that could otherwise be masked by the effect of significant non-operating related expenses that management does not consider ongoing. The Company defines adjusted net (loss) income to mean net (loss) income adjusted for net loss from discontinued operations and the after tax impact of the litigation contingency accrual.

- Adjusted operating cost helps the reader understand the trends in our general, administrative, technology and other costs. The Company defines adjusted operating costs as operating costs excluding commissions and other agent-related costs and the litigation contingency.

Adjusted EBITDA, adjusted net income, and adjusted operating costs should not be considered in isolation from, or as a substitute for, financial information prepared in accordance with U.S. GAAP.

Safe Harbor Statement

The statements contained herein may include statements of future expectations and other forward-looking statements that are based on management’s current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. These statements include, but are not limited to, statements about future cost saving measures; improvements in technology and operational processes; revenue growth; dividends; statements relating to the settlement of antitrust lawsuits; and financial performance. Such forward-looking statements speak only as of the date hereof, and the Company undertakes no obligation to revise or update them. Such statements are not guarantees of future performance. Important factors that may cause actual results to differ materially and adversely from those expressed in forward-looking statements include changes in business or other market conditions; outcomes of ongoing litigation; the difficulty of keeping expense growth at modest levels while increasing revenues; and other risks detailed from time to time in the Company’s Securities and Exchange Commission filings, including but not limited to the most recently filed Quarterly Report on Form 10-Q and Annual Report on Form 10-K.

Media Relations Contact:

eXp World Holdings, Inc.

Investor Relations Contact:

Denise Garcia

EXP WORLD HOLDINGS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except share amounts and per share data)